A New Kind of Wealth: Gen Z Is Rewriting the Rules

For years, financial success adhered to an acquainted pattern: earn gradually, save strongly, acquire a home, and plan for retirement. Yet Gen Z is coming close to money with a fresh point of view. As opposed to focusing entirely on lasting buildup, this generation is prioritizing balance, well-being, and intentional living.

This change has given rise to the concept of soft saving. It's not regarding deserting economic objectives but redefining them. Gen Z wants to live well today while still being mindful of tomorrow. In a world that feels progressively unsure, they are picking gratification currently as opposed to postponing joy for years.

What Soft Saving Really Means

Soft conserving is a state of mind that values psychological wellness together with monetary responsibility. It reflects a growing idea that cash must sustain a life that feels meaningful in the present, not just in the long run. Instead of pouring every extra buck right into savings accounts or retirement funds, several young people are selecting to spend on experience, self-care, and individual advancement.

The rise of this philosophy was increased by the worldwide events of current years. The pandemic, economic instability, and changing job dynamics motivated lots of to reevaluate what truly matters. Confronted with unpredictability, Gen Z started to embrace the concept that life ought to be enjoyed along the road, not after getting to a cost savings objective.

Emotional Awareness in Financial Decision-Making

Gen Z is coming close to money with psychological awareness. They desire their financial options to align with their values, psychological health, and way of life aspirations. Instead of stressing over conventional standards of wealth, they are seeking objective in just how they earn, spend, and conserve.

This could look like costs on psychological health resources, funding innovative side projects, or focusing on flexible living arrangements. These options are not spontaneous. Rather, they mirror a conscious effort to craft a life that supports happiness and stability in such a way that really feels genuine.

Minimalism, Experiences, and the Joy of Enough

Several young people are turning away from consumerism in favor of minimalism. For them, success is not about having much more however regarding having sufficient. This connections directly into soft cost savings. Rather than determining riches by material belongings, they are focusing on what brings genuine delight.

Experiences such as travel, concerts, and time with buddies are taking precedence over luxury items. The change mirrors a much deeper wish to live fully rather than accumulate constantly. They still save, but they do it with intention and equilibrium. Conserving belongs to the plan, not the whole focus.

Digital Tools and Financial Empowerment

Technology has actually played a significant role fit exactly how Gen Z communicates with money. From budgeting applications to investment platforms, electronic tools make it less complicated than ever before to stay notified and take control of personal funds.

Social network and online areas likewise affect exactly how economic concerns are established. Seeing others develop flexible, passion-driven occupations has motivated many to look for similar way of lives. The accessibility of monetary details has encouraged this generation to create methods that work for them instead of adhering to a conventional course.

This raised control and awareness are leading lots of to choose trusted experts. Therefore, there has been a growing rate of interest in services like wealth advisors in Tampa that comprehend both the technical side of financing and the emotional inspirations behind each choice.

Safety Through Flexibility

For past generations, economic stability usually implied adhering to one task, acquiring a home, and complying with a dealt with strategy. Today, stability is being redefined. Gen Z sees versatility as a kind of safety and security. They value the capacity to adapt, pivot, and check out numerous income streams.

This redefinition encompasses just how they look for financial support. Several are interested in techniques that take into consideration career modifications, job work, creative goals, and transforming household characteristics. Rather than cookie-cutter guidance, they desire tailored assistance that fits a vibrant lifestyle.

Experts that supply insight right into both preparation and versatility are ending up being significantly beneficial. Provider like financial planning in Tampa are evolving to include not just traditional investment recommendations yet also techniques for preserving economic health throughout transitions.

Realigning Priorities for a Balanced Life

The soft savings pattern highlights a crucial change. Gen Z isn't overlooking the future, yet they're choosing to live in a way that doesn't compromise joy today. They are seeking a middle course where short-term satisfaction and long-lasting stability exist side-by-side.

They are still purchasing retirement, repaying financial obligation, and structure cost savings. However, they are likewise including leisure activities, travel, downtime, and remainder. Their variation of success is wider. It's not just about total assets yet regarding living a life that really feels abundant in every sense of the word.

This point of view is encouraging a wave of modification in the economic solutions industry. Advisors who focus only on numbers are being changed by those that understand that values, identity, and emotion play a central function in economic choices. It's why much more people are turning to asset management in Tampa that takes a holistic, lifestyle-based method to wide range.

The brand-new requirement for monetary wellness blends strategy with compassion. It listens to visit here what people in fact desire out of life and builds a strategy that supports that vision.

Follow the blog site for more understandings that show reality, modern cash habits, and just how to grow in ways that really feel both functional and individual. There's more to discover, and this is just the beginning.

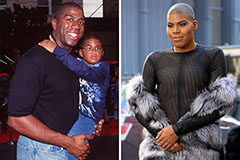

Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!